November turned out to be probarbly the most difficult month that I've ever done this strategy (yes, been doing it for a while before this experiment)

November suffered a terrible drawdown which almost made the biggest drawdown on record of the system for the last three years. Although we knew the worst case scenario could happen we just didnt think it would happen at this stage of the game - 6 months down the line would be fine but not in the first 2 months please!!

The month started well as on the 4th day we were at new highs of account equity thanks to a slight change to the system. Let me explain.

Although Grail is a long term system that has been worked out over a long period of time - every six months we re-evaluate the settings in use to make sure it's still at it's optimum for the prevailing market conditions. 2005 has been a very volatile year for cable and as such a change in one of our parameters was deemed to be necessary. After running the backtests we were convinced enough to make the change and this was implemented on the 1st of the month.

You may be asking is that is what caused the drawdown and the answer is no, on running the previous scenario the drawdown would have been larger although not to a large degree.

At the point of the lowest drawdown I must admit that we got very nervous - especially as it was eating into original capital. However true to form on the very next day the method gave what we expected it to do and came in ok.

The month is not to target though. To make the million we must hit an average of 22% per month. This should average out though as we go through the next 18 months. In our tests we had months which increased equity as much as 60% and the next 18 months should give some months much higher than others.

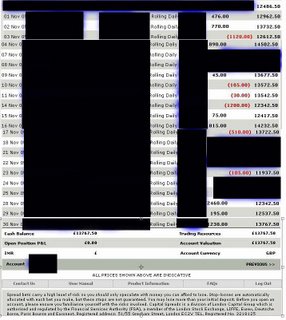

Onto the figures then - check back New Years Eve to see if we reached our December target of 17k equity

- Opening balance:£12,486

- Closing Balance: £ 13,767

- P/L: £1281

- % Gain on account: 10.2%

- Lowest account value: £ 9,882

- Highest account value: £14,502

- Maximum Drawdown: £4,620 = 31.8%